Some Known Factual Statements About Home Insurance In Dallas Tx

Wiki Article

Commercial Insurance In Dallas Tx for Beginners

Table of ContentsThe 7-Second Trick For Home Insurance In Dallas TxNot known Details About Commercial Insurance In Dallas Tx Top Guidelines Of Commercial Insurance In Dallas TxThe 6-Second Trick For Life Insurance In Dallas TxOur Commercial Insurance In Dallas Tx IdeasThe Facts About Health Insurance In Dallas Tx Uncovered

And also because this coverage lasts for your whole life, it can aid support lasting dependents such as children with disabilities. Disadvantage: Expense & complexity an entire life insurance coverage plan can be considerably extra expensive than a term life plan for the same fatality benefit amount. The cash worth element makes entire life much more complicated than term life as a result of charges, taxes, interest, and also various other terms.

Cyclists: They're optional add-ons you can use to tailor your plan. Some policies come with motorcyclists immediately consisted of, while others can be included at an added expense. Term life insurance policy policies are generally the best service for people who need inexpensive life insurance policy for a certain duration in their life.

10 Easy Facts About Home Insurance In Dallas Tx Shown

" It's constantly recommended you talk with a licensed agent to identify the ideal service for you." Collapse table Since you recognize with the fundamentals, below are extra life insurance plan kinds. A number of these life insurance policy options are subtypes of those featured over, implied to offer a specific function.Pro: Time-saving no-medical-exam life insurance policy offers quicker access to life insurance policy without having to take the medical exam (Home insurance in Dallas TX). Disadvantage: People who are of old age or have several health problems might not be qualified. Best for: Anyone who has couple of wellness difficulties Supplemental life insurance, additionally called voluntary or voluntary supplemental life insurance policy, can be used to connect the insurance coverage void left by an employer-paid team plan.

Unlike various other plan kinds, MPI only pays the fatality advantage to your home loan lender, making it a far more minimal alternative than a typical life insurance policy plan. With an MPI plan, the recipient is the home mortgage company or lender, rather of your family, and the survivor benefit decreases gradually as you make mortgage repayments, comparable to a lowering term life insurance coverage plan.

Some Known Factual Statements About Insurance Agency In Dallas Tx

Because AD&D just pays under details conditions, it's not a suitable alternative for life insurance coverage. AD&D insurance coverage just pays out if you're injured or killed in a crash, whereas life insurance pays for the majority of hop over to these guys causes of fatality. Because of this, AD&D isn't appropriate for everybody, but it may be beneficial if you have a risky occupation.

Getting The Life Insurance In Dallas Tx To Work

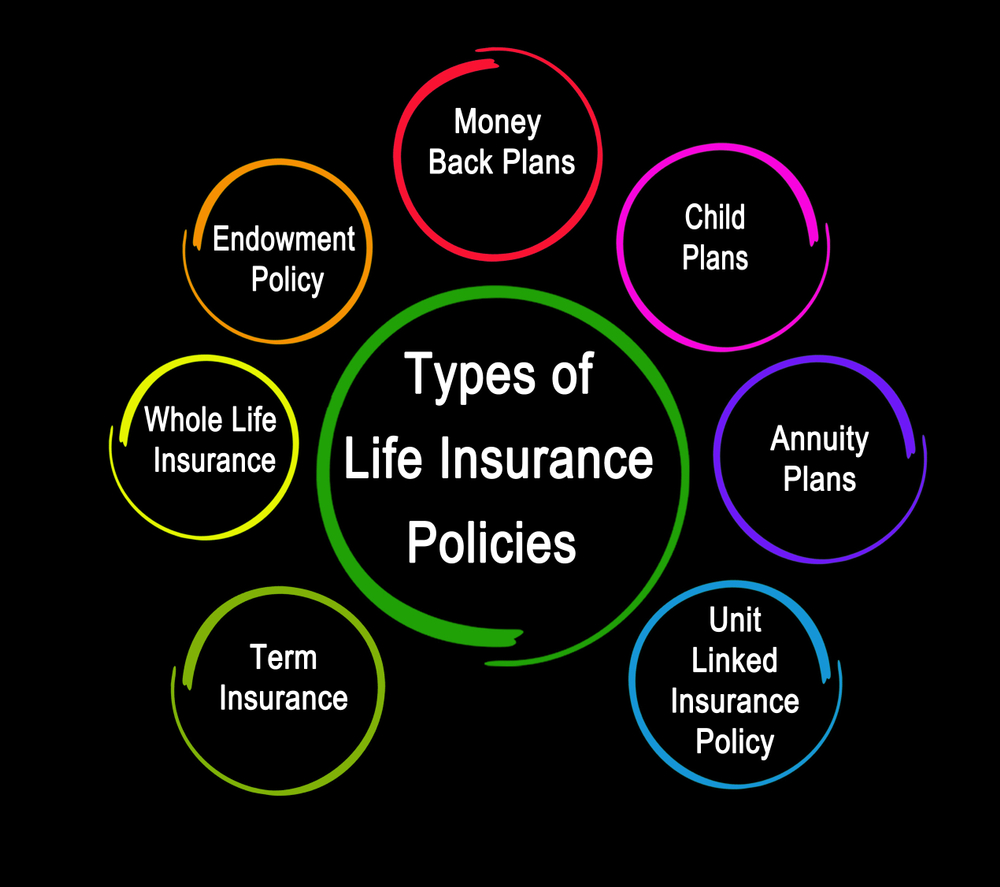

Best for: Couples who don't get approved for 2 specific life insurance policy plans, There are 2 main kinds of joint life insurance policy policies: First-to-die: The policy pays out after the initial of both spouses dies. First-to-die is one of the most comparable to an individual life insurance policy plan. It aids the enduring policyholder cover costs after the loss of financial backing.After that, they'll have the ability to aid you compare life insurance policy providers quickly and easily, and find the finest life insurance policy firm for your situations. What are the 2 primary sorts of life insurance coverage? Term and also long-term are the 2 primary sorts of life insurance coverage. The major difference in between both is that term life insurance policy policies have an expiry day, providing protection in between 10 and 40 years, and also permanent policies never end.

Both its period and money worth make permanent life insurance policy sometimes much more costly than term. What is the least expensive kind of life insurance policy? Term life insurance is normally the you could try here most affordable and also comprehensive kind of life insurance policy since it's straightforward as well as gives monetary protection throughout your income-earning years. Just how much you pay for life insurance policy, nevertheless, will certainly depend upon your age, gender, lifestyle, and also health and wellness.

The Definitive Guide for Home Insurance In Dallas Tx

Entire, global, indexed global, variable, and interment insurance coverage are all kinds of permanent life insurance coverage. Permanent life insurance coverage usually comes with a cash money worth and has greater costs.life insurance policy market in 2022, according to LIMRA, the life insurance policy study organization. Term life costs represented 19% of the market share in the exact same period (bearing in mind that term life premiums are much more affordable than entire life premiums).

There are four basic parts to an insurance contract: Statement Page, Insuring Contract, Exclusions, Problems, It is essential to understand that multi-peril policies might have details exemptions and also problems for each and every sort of insurance coverage, such as crash coverage, medical settlement coverage, responsibility protection, and so forth. You will certainly require to make certain that you read the language for the specific insurance coverage that relates to your loss.

Some Known Details About Home Insurance In Dallas Tx

g. $25,000, $50,000, and so on). This is a summary of the major assurances of the insurance provider as well as states what is covered. In the Insuring Agreement, the insurance company agrees to do certain things such as paying losses for protected risks, giving specific services, or consenting to defend the insured in a responsibility suit.Instances of omitted residential or commercial property under a property owners plan are personal effects such as a car, a pet, or a plane. Conditions are arrangements inserted in the plan that certify or position limitations on the insurance firm's debenture or execute. If the plan conditions are not fulfilled, the insurance company can reject the case.

Report this wiki page